There are three State-sponsored plans for State retirees that are under age 65/non-Medicare-eligible. All plans are administered by Blue Cross & Blue Shield of Rhode Island (BCBSRI). State subsidies are applicable to these three plans:

You must IMMEDIATELY start collecting your State pension upon retirement in order to qualify for State-sponsored medical and prescription coverage as well as any State subsidy.

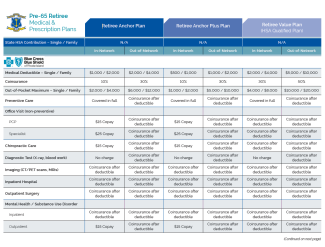

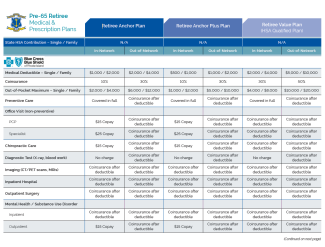

State retirees may elect one of three plans: Retiree Anchor, Retiree Anchor Plus and Retiree Value.

Retiree Anchor and Retiree Anchor Plus offer identical coverage as the Anchor and Anchor Plus plans for active employees except for three things:

See below for how the pre-65 retiree health plans compare. Visit the Glossary page for more information on key terms like coinsurance, deductible and out-of-pocket maximum.

A brief plan outline

Retiree Anchor Plus SBC (2024) PDF file, less than 1 mb megabytes Retiree Anchor SBC (2024) PDF file, less than 1 mb megabytes Retiree Value SBC (2024) PDF file, less than 1 mb megabytes Summary Plan Description ("Benefits Booklet")A comprehensive description regarding the terms of coverage, including exclusions and limitations

Retiree Anchor Pus Plan Benefits Booklet 2024 PDF file, about 1 mb megabytes Retiree Anchor Plan Benefits Booklet 2024 PDF file, about 1 mb megabytes Retiree Value Plan Benefits Booklet 2024 PDF file, about 1 mb megabytes EligibilityYou are eligible to enroll in State-sponsored medical and prescription coverage for you and your family if:

Spouses, dependents, and public school teachers that retire through ERSRI are also eligible to enroll, but they are not eligible for any State subsidy towards the cost of their coverage..

Enrollment / CancellationRetirees may enroll in State-sponsored medical and prescription coverage during one of the following periods:

Except for enrollments occurring during the open enrollment period and age 59 enrollments, all retiree coverage elections become effective as of the first of the month following the enrollment date.

If you are a current employee getting ready to retire, or you are a pre-65 retiree looking to change coverage within an eligible enrollment period, complete and submit the Pre-65 Retiree Health Coverage Election Form – Date of Retirement ON OR AFTER 10/1/08 or the Pre-65 Retiree Health Coverage Election Form – Date of Retirement BEFORE 10/1/08 to the Office of Employee Benefits as instructed on the form. Please note that:

If you want to cancel your health coverage, please submit the Retiree Health Care Cancellation Form to the Office of Employee Benefits.

Premium RatesSee below for the full and State-subsidized premium rates for retiree medical and prescription coverage.

Any retiree subsidy percentage is applied to the applicable monthly premium rate, and the resulting amount is deducted from the retiree's monthly pension check. See State Subsidies for more information on subsidy percentages.